Should you get life insurance from CIGNA? Can I cash in my term life insurance? Can you get term life insurance as a senior?

How it works: Select a coverage amount and enroll (pending approval if needed.) Once you’ve enrolle you’re covered for a specific period of time, or “term. Set aside a certain amount of money out of each paycheck, and contribute through convenient payroll deductions or lump-sum payments. Cigna Term Life Insurance. Life insurance helps your employees and their families stay financially protected and better prepared.

Individual Whole Life Insurance. Available for around $per month 1. If you are an active, full-time employee and at least work hours per week for your employer, in the United States, you are eligible for this product. Products may not be available in all areas. Insurance policies may contain exclusions, limitations, reduction of benefits, and terms under which the policies may be continued in force or discontinued.

All insurance policies and group benefit plans contain exclusions and limitations. Call CIGNA Group Insurance : For Customer Service on: Leave Plans: 1(888)84CIGNA : GUL: 1(800)828. Medical Underwritting: Online Technology: 1(866)607. Dallas Claims Office: Eden Prairie Claims Office: 1(800)352.

Pittsburgh Claims Office: 1(800)238. Glendale Claims Office: 1(800)781. Compare the Best Life Insurance Providers. Please note the Web Intake feature is not compatible with all browsers.

Group Term Life Insurance provides a firm foundation for employees by offering a competitive, value-added life benefit. LINA Group Term Life product offers protection, a terminal illness benefit, bereavement counseling and beneficiary services to employees and their families. If you would like to purchase additional life insurance protection for you or your dependents, you may do so through CIGNA’s voluntary life insurance. You must be a full-time employee and work a minimum of hours per weeak to be eligible.

This plan is a voluntary plan, meaning if you participate you are responsible. Explore the below to start taking advantage of any or all of these offerings today. The terminal illness benefit may be taxable. Life insurance claims A claim is the term used for when a beneficiary of a Life Insurance policy requests payment of that policy. Generally, a claim is made on a life insurance policy, when the insured person passes away.

However, in some cases it is possible to make an advance claim if the insured person is diagnosed with a terminal illness. Downloa fax, print or fill online more fillable forms, Subscribe Now! CIGNA Life Insurance Company of North America CIGNA Life Insurance Company of New York, New York, NY CIGNA Group Insurance P. Plan Description: The individual whole life insurance policy is a permanent life insurance plan with premiums payable for the lifetime of the insured.

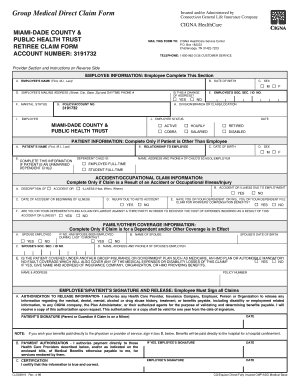

The benefit is paid to the designated beneficiary(ies) at the time of the insured’s death. The applicant must sign and date this form. This form cannot be considered unless received within days of the date it is dated. It has been in business for over years. CIGNA provides group universal life insurance that lets eligible employees supplement their basic life insurance at an additional cost.

Its insurance subsidiaries are major providers of medical, dental, disability, life and accident insurance and related products and services, the majority of which are offered through employers and other groups.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.