Life insurance policies contain certain exclusions, limitations, exceptions, reductions of benefits, waiting periods and terms for keeping them in force. SHARE Term life insurance is usually the most affordable type of life insurance. Supplemental Life coverage under your employer’s plan terminates when your employment ceases, when you retire, when your Supple mental Life contributions cease or upon termination of the group contract.

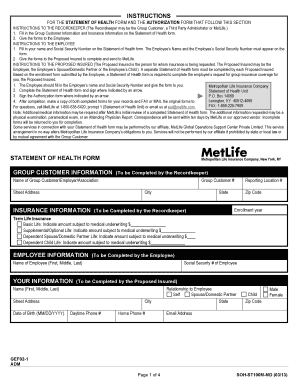

Supplemental health products provide a lump-sum payment to help cover the unexpected medical expenses that can quickly add up. Financial support for expenses health insurance might not cover. How long do I have to enroll in supplemental life insurance? You may apply for up to the guaranteed issue amounts of supplemental life insurance without submitting evidence of insurability to MetLife. The deadlines to apply are as follows: No later than days after the date you become eligible for SEBB benefits.

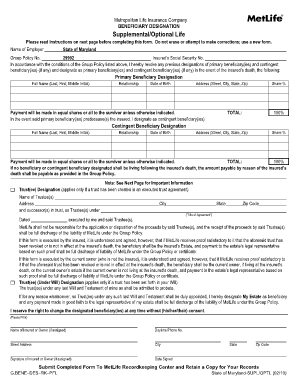

Metropolitan Life Insurance Company. Optional Term Life, Dependent Life and ADD coverage are provided under a group insurance policy (Policy Form GPNP99) issued to your employer by MetLife. Group Variable Universal Life (GVUL) is sold by prospectus only.

MetLife’s Accident and Hospital Indemnity Insurance may be subject to benefit reductions that begin at age 65. Securing additional life insurance outside of the supplemental life insurance that your employer offers may not be as hard you think. MetLife administers the Delivering the Promise,.

In fact, at Protective Life , you can get a free online quote in just four easy steps - with no obligation to buy. Exclusively for AARP Members. We are pleased to be the first life insurance company to earn Fitwel Certification System certifications for three of our corporate buildings, including our global headquarters in New York City. Supplemental Life Insurance is an Anytime Benefit and can be reduced or discontinued during the plan year through the Employee Portal.

Rates to cover your child(ren) are also shown. Use the table below to calculate your premium ba sed on the amount of life insurance you will need. Example: $100Supplemental Life Coverage 1. Enter the rate from the table (example age 36) $0. Life and accident insurance can provide financial security for your beneficiaries in the event of your terminal illness or death. Supplemental life insurance , also called voluntary supplemental life insurance , refers to any group life insurance you purchase on top of what is offered by your employer.

Payments are typically handled by your employer deducting the premiums from your paycheck. Keeping your personal information secure is a top priority. Learn how you can help.

Child(ren)’s Eligibility: Dependent children ages days to years ol or years old if a child is a full -time student, are eligible for coverage. Listed below are your monthly rates. Additional products will be added in the future.

With a Will, you can define your most important decisions such as who will care for your children or inherit your property. Basic Life Insurance is provided at no cost to permanent employees as negotiated or as indicated in the Terms of Employment. Supplemental Term Life insurance serves as a foundation of financial protection and is offered through MetLife.

If you enroll in ADD you must enroll in a minimum of $10of Supplemental Life Benefits. Accidental Death and Dismemberment (ADD) can be added to your VSB package. Also at age 7 the basic coverage will reduce to $000.

Protect your loved ones and secure their future.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.