Medicare Supplement Insurance Plans from Blue Cross and Blue Shield of Texas. Choose coverage that meets your needs and budget. Get your Free Information Booklet today. Subsidized or unsubsidize e Health has a plan for you.

Find premiums that fit your budget with e Health. Our licensed agents are waiting to help. Learn about tax benefits of owning an HSA and the numerous additional benefits. Get contributing, investing, saving, and paying for utilizing your health savings account.

Does a HSA qualify as medical insurance? What does HSA stand for in health insurance? When a HSA is not a good idea? Why should I get a HSA? We offer affordable health insurance for individuals, families and employers HSA Insurance - Affordable Health Insurance To use the full functionality of this site, it is necessary to enable JavaScript.

Funds deposited are not taxe nor are withdrawals for qualified expenses. Federal and state laws and regulations are subject to change. HSA Health Insurance has changed its name to MotivHealth. We’re motivated to change healthcare. The health plan passes through a portion of the health plan premium as a deposit to.

You — not your employer or insurance company — own and control the money in your HSA. Health Savings Account ( HSA ) A type of savings account that lets you set aside money on a pre-tax basis to pay for qualified medical expenses. Happens to the best of us!

The funds contributed to an account are not subject to federal income tax at the time of deposit. Money in the savings account can help pay the deductible. Anthem Insurance Companies, Inc.

Once the deductible is met, the insurance starts paying. Money left in the savings account earns interest and is yours to keep. Deposits to the HSA are tax-deductible and grow tax-free. An HSA works in conjunction with high deductible health insurance. Your HSA dollars can be used to help pay the health insurance deductible and qualified medical expenses, including those not covered by the health insurance , like dental and vision care.

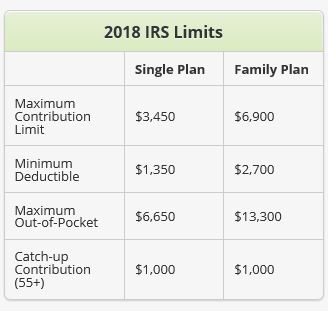

Any funds you withdraw for non-qualified medical expenses will be taxed. You can only have one when you also have a type of insurance known as a high-deductible health plan, commonly called an HDHP. As the name indicates, an HDHP has a higher annual deductible compared to a traditional health plan. It provides insurance coverage and a tax-advantaged way to help save for future medical expenses. HSA -qualified health plans typically cost less than traditional plans and the money saved can be put into your HSA.

You must be an eligible individual to qualify for an HSA. No permission or authorization from the IRS is necessary to establish an HSA. HSA Bank Mobile gives you the tools to take control of your health accounts.

Safe and secure, the mobile app offers real-time access for all your account needs, hours a day, seven days a week. A health savings account is the perfect plan for managing the high cost of healthcare… At Ramsey Solutions and even for my family, we trust the team at HealthEquity.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.